The Growth of Compensation For Most Americans Has Slowed

This chart, a simplified version of a figure from the Financial Crisis Commission Inquiry Report, shows that from 1940-1980 the financial and nonfinancial sectors both grew at the same pace.

Since that time, however, average financial sector compensation has skyrocketed while nonfinancial has increased at a much slower pace.

To illustrate:

The chart shows that from 1950-1980 average compensation in the nonfinancial sector grew by nearly $20,000.

By contrast, over the next thirty years it grew by only about $10,000.

In other words, if average nonfinancial sector compensation had kept up with the 1950-1980 pace, it’d be around $70,000 or more today.

What Created the Recent Disparity?

There were likely many causes for this recent disparity (including the invention of the computer, which let Wall Street handle complex transactions), but we’ll just address two:

Reason #1: Changes In the Tax Code

The top marginal tax rate and the capital gains tax rate started dropping in the 1980s, encouraging more and more people to give their surplus money to Wall Street to invest. The theory was that this would jump-start the entire economy—a theory called into question by the chart above, since growth in the nonfinancial sector slowed after 1980.

At any rate, one thing these changes in the tax code definitely led to was more surplus money on Wall Street, and when there’s more money on Wall Street there’s more money for Wall Street. After all, Wall Street likes low top marginal taxes and low capital gains taxes because it means more fees for them.

Of course, these lower rates have critics. One of the more poignant critics is Sheila Bair, a Republican and former chairman of the FDIC (appointed by George Bush). Speaking of the low capital gains tax rates, she says:

The rationale for this $90-billion-a-year tax benefit is that it spurs job-producing investments, though there is little credible economic evidence that this is the case. Equally likely is that it contributes to a glut of investment dollars searching for return, with too few opportunities in the “real” economy. So we create incentives for banks to come up with an endless array of complex “structured” financial products to meet investors’ insatiable demand for return. Just how many jobs did all of those CDOs-squared give us anyway?

And what does this tell young people? Get a job and find the cure for cancer, and we will tax you at 35%. But hey, go manage a hedge fund and only pay 15%.

Bair is right to focus the attention on hedge fund managers. More than any group, hedge fund managers have led the drive in the disparity between the financial and nonfinancial sector:

We have a tax code that encourages this insane disparity.

Reason #2: Deregulation on Wall Street

In the 1990s and early 2000s, three laws (all with fabulously boring names!) caused an intense concentration in the banking industry.

The first, called the “Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994,” allowed interstate bank mergers, creating bigger banks.

The second, called the “Gramm-Leach-Bliley Act of 1999,” repealed Glass-Steagall, a depression-era law that split investment and commercial banks. The repeal of Glass-Steagall meant that the creation of enormous bank conglomeration was now legal (though Glass-Steagall had been eroding for years leading up to 1999).

The third, called “The Commodity Futures Modernization Act of 2000,” deregulated complex financial transactions called derivatives. This law effectively allowed Wall Street to corner the market on a deregulated industry, slanting the playing field in their favor and allowing them to eat up other smaller market players.

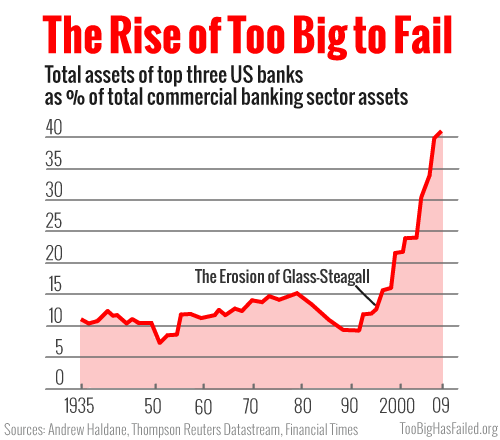

Here’s what it all looked like:

By 2009 the three biggest banks, which had held about 10% of total commercial bank assets for over 60 years, suddenly held over 40%. This concentration of power led to the rise of “too big to fail.” It also led to a unified and concentrated financial sector that continued to game the system in their favor. In fact, their political contributions more than tripled from 1996 to 2012.

So What?

We want to conclude by making two points forcefully.

The first is that Wall Street hasn’t always been this way. There are people who seem to justify the status quo by saying there have always been bad apples and inequality in America. That statement is technically true, of course. But it’s important that people understand that the Wall Street of today isn’t the same as the Wall Street of yesterday. Things have fundamentally shifted in recent decades.

The second point is that we can change this. If you look again at the graph at the top of the page, you’ll see that after the Great Depression the disparity between the financial and nonfinancial sectors closed. If it happened once, it can happen again. We can—with enough political will—reform Wall Street and get back to an economy where all industries can grow better together. To do this, we need to revamp the tax code and revamp regulations among many other things. But history proves that it is possible to do these things.

So let’s do them.