At today’s Senate Banking Committee hearing, Elizabeth Warren introduced the 21st Century Glass-Steagall Act of 2013, co-sponsored by Senators McCain, Cantwell, and King. This new bill mirrors the original 1933 Glass-Steagall Act, which separated traditional banking activity (like checking and lending) from the riskier activity investment banking (like derivatives).

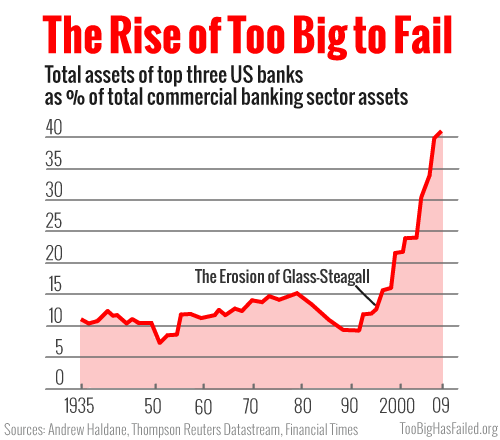

The original law was repealed in 1999 by the Gramm-Leach-Bliley Act, though Glass-Steagall had been eroding for years leading up to that point. Gramm-Leach-Bliley, along with several laws passed during that era, allowed the big banks to transform into megabanks, creating “too big to fail.”

To illustrate, the chart below shows that from 1935 to 1990 the three biggest banks averaged around 10% of total bank assets, but by 2009 they suddenly had over 40%.

This new bill from Senator Warren will reverse this trend and make the banks smaller. After all, the three biggest banks (Chase, Bank of America, and Citi) are all bloated conglomerate banks that have enormous traditional and investment subsidiaries, so these banks wouldn’t be able to continue as they’re currently instituted under the new Glass-Steagall Act. Instead these megabanks would be broken up into much smaller firms.

What’s more, the new Glass-Steagall Act will make it so banks cannot gamble with derivatives using depositor’s money, as they do today. Currently, depositors at banks like Chase, Bank of America, or Citi implicitly use their money to help these banks make amplified bets that have the potential to cause another global meltdown. Reintroducing Glass-Steagall will make it so depositor’s money cannot be used for the derivatives market. This would be a major step toward restoring sanity to Wall Street.

For more on why it’s important to restore Glass-Steagall, see this compilation video that shows expert after expert calling to restore it:

Perhaps one of the best quotes from the video is from University of Chicago economist Luigi Zingales who says the strength of Glass-Steagall was its simplicity. The new bill from Warren shares that strength. It’s a mere 30 pages (compare that to the 30,000 pages of rules that will come out of Dodd-Frank).

You can read the full text of the bill here, or glance at the fact sheet (thanks to @peteshroeder for pointing us to the documents via Twitter).

YES!

Keep em dizzy Sen. Lizzy

I’m with you senator Warren!!!!!!!!!

I agree if they are to big to fail the banks are to BIG !!!

What about a government too big to fail???

What about it? What about UFO’s? The Loch Ness Monster? Bigfoot? What about tinfoil hats? You should concern yourself with these topics, as, they have more of a foundation in reality that your comment.

hopefully the dinosaurs will agree…lets see how it play out

bless you, mam. you’re an american hero. Thank you so much.

Didn’t the 1990s also see several I-Banks go public? Seems like a relevant confounding variable.

I can see G-S relationship with size for the combined banks, but argument that it made I-Banks bigger is very loosey-goosey (relies on hand-wavy competition stuff, which is ok but maybe not ironclad).

What they ought to do rather than try to regulate banks and still keep the possibility open for bailouts is make it illegal to bail out ANY industry - banks, automobiles, insurance, etc. Let the free market decide winners & losers!

The free market has decided that we’re all losers unless we already own everything.

There may be more to this than meets the eye. Warren spoke frequently of restoring Glass-Steagall before she was elected Senator. The moment she was sworn in, she became complete silent on the matter, despite the fact that HR 129 to restore Glass-Steagall had been introduced in the House and had over 60 co-sponsors. Then on May 16, Iowa Senator Tom Harkin introduced a Senate version of the bill (which restores the original Glass-Steagall Act.) Warren said nothing and did not co-sponsor. Now, two months later, she introduces a competing bill, called a “Glass-Steagall for the 21st Century.” The 20th Century version was fine, and it remains to be seen exactly why she is doing what she is doing now.

It’d be honest to say the original proposal (to restore Glass-Steagall) comes from the american economist Lyndon LaRouche, who has been proposing to break big banks, since 2007.