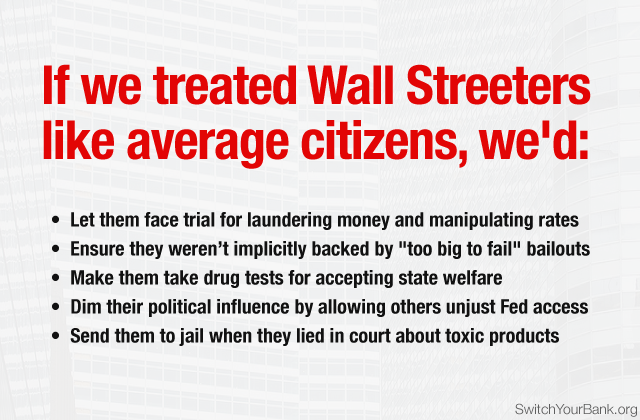

An article from Harvard lecturer Steven Strauss asks (somewhat facetiously) whether we shouldn’t drug test CEOs of banks receiving federal aid if we’re going to test other recipients of such aid. It got us thinking about the ways in which Wall Streeters symbolize a double standard, and so we listed a few things in the image above to prove our point. Perhaps one of the best reasons to switch banks is to put an end to the double standard.

Here are the specifics on each of the things on the list:

- HSBC didn’t have to face trial for years of money laundering

- UBS (and many other banks) manipulated interest rates without facing trial

- Only certain types of welfare recipients are forced to take drug tests

- The big banks have an enormous advantage in lobbying power

- Goldman Sachs lied to customers and Congress about its Abacus deal

The double standard allows Wall Streeters to continue to get away with practices that hurt the rest of us. It’s why Mike Lux, co-founder of Democracy Partners, was able to rightly say of Wall Streeters that “when they screw up in ways that hurt the rest of us, even when they blatantly violate the law, the fact that they are never seriously punished means they have no incentive to stop.” It’s time we gave them an incentive to stop by switching from these banks to local lenders that don’t practice this double standard.