When we named our site TooBigHasFailed.org, we aimed to encompass a topic bigger than just Wall Street. After all, in almost every case, the problems on Wall Street aren’t limited exclusively to the Street. Instead, the problems typically stem from the union of Wall Street and Washington. The problems, in other words, are the result of cronyism. In one sense that’s what we mean by Too Big Has Failed. The overwhelming union of government and business has failed—especially when it comes to Wall Street’s union with Washington.

It’s for this reason that Wall Street is a central focus in Hunter Lewis’s new book Crony Capitalism in America: 2008-2012. Wall Street is among the worst players on this front, with people zipping through the revolving door like flies though an open window on a summer day. To illustrate:

And that image shows only a tiny piece of the problem. In Crony Capitalism, Lewis lists just the people from Goldman Sachs who’ve pushed through the revolving door over the past few years, and the list spans six pages. Think of how long the list would be if it showed every person from Wall Street or Washington who have played on both teams in recent decades. The list could be a book in itself.

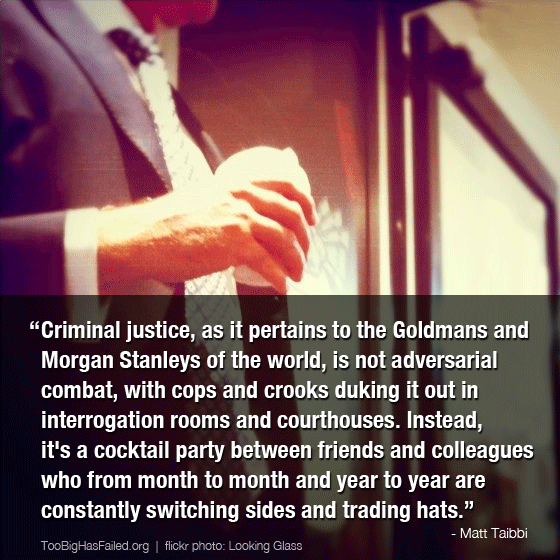

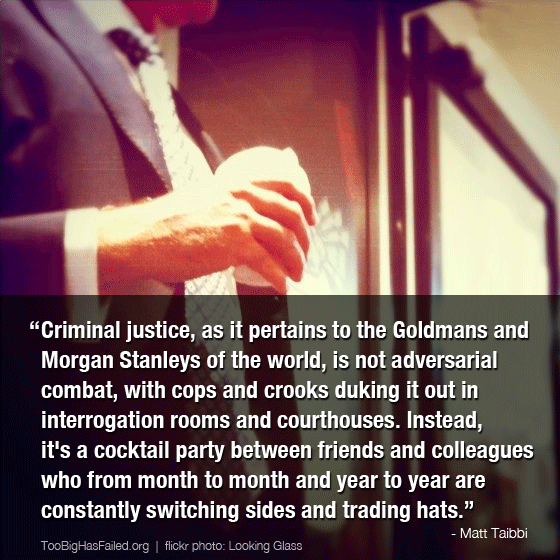

One reason Americans should care about this topic is that it reveals a system of two-tiered justice. Big firms can get away with crimes that other smaller firms (or individuals) could not get away with. Lewis talks about this in a section about Wall Street’s key regulator, the SEC. It turns out (unsurprisingly) that the SEC hasn’t prosecuted Wall Street the way it has prosecuted other smaller players since the financial crisis. In getting at why this is, Lewis quotes one of our favorite passages from writer Matt Taibbi:

“It’s a cocktail party between friends.” That is perhaps the perfect way to explain what’s wrong with the union of Washington and Wall Street.

It’s time that we reform this system. Lewis’s book aims to do just that. While the book’s scope is wider than the scope of our site (as the book includes data on cronyism in healthcare, law, and military), it’s a book that gets at the heart of what’s wrong with contemporary US politics: Big business has become big government and big government has become big business.

It’s a book that lays out all the data needed to support the theory that cronyism is rampant and that cronyism is wrong. We’re adding it to our reading list. Check out the book here.

Plus, we recommend checking out Lewis’s site, AgainstCronyCapitalism.org.