Note: We haven’t been posting as much recently because we’ve been creating an ebook that will explain exactly why too big has failed. It’ll be an awesome exposé of Wall Street. Look for a release by the end of July. In the meantime we’ve found a few crazy bank stories we want to share.

Note: We haven’t been posting as much recently because we’ve been creating an ebook that will explain exactly why too big has failed. It’ll be an awesome exposé of Wall Street. Look for a release by the end of July. In the meantime we’ve found a few crazy bank stories we want to share.

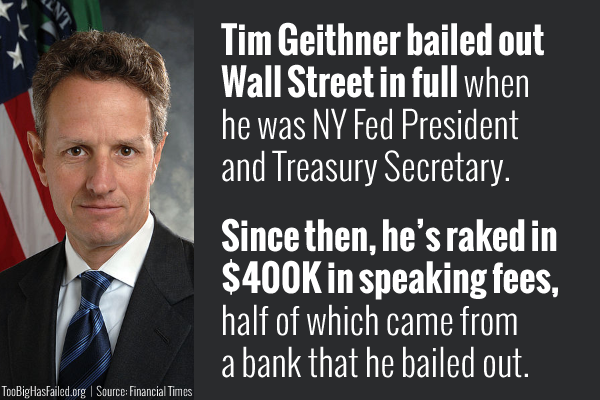

Tim Geithner’s Kickbacks

The Financial Times has the news: Tim Geithner has made $400,000 in speaking fees since he left his role as Treasury Secretary—$200,000 of which came from a single speech he gave at Deutsche Bank.

In 2009, Deutsche Bank received nearly $12 billion from AIG after AIG was bailed out by the US taxpayer, with Geithner adamantly insisting that AIG receive 100 cents on the dollar (i.e. no haircut). So $200,000 was the least Deutsche Bank could do for Geithner, right?

It seems to us that Wall Street uses speaking fees as a loophole to pay public servants back for their “service” when they leave office. We’ve seen the same thing happen with Alan Greenspan and Larry Summers, and it’s a horrible precedent. If public servants know they can join the 1% simply by giving a speech or two after they leave office, then they’re bound to privilege certain citizens (the ones with the money) more than others.

It’s not public service if the public isn’t served.

Bank of America’s Twitter Bot

In a hilarious post from blogger Eksith Rodrigo you can see Bank of America’s Twitter bot giving automated responses to protestors complaining about the bank. The conversation was initiated when Twitter user @darthmarkh posted a picture of his chalk protest. After that, @BofA_Help unwittingly (we mean literally: no wits) joined the conversation. See the interchange at Eksith’s blog, or below:

Bank of America’s Foreclosure Fiasco

The last story we want to share is about the Mata family, who lived in the same home for 10 years before they were hit by the Great Recession. Since then they applied for loan modifications from Bank of America repeatedly, but were given the run around. The article talks about Gisele Mata’s experience (who is the mother in the family):

Every time Gisele would reapply for a loan, she would get a new single point of contact (SPOC). She would receive letters from different people inside the bank with contradictory information, some from an old SPOC saying she was denied a modification (without explanation), others from a new SPOC saying that her paperwork was in the underwriting process. This matches what Bank of America whistle-blowers have stated, that customer service representatives would facilitate delay by claiming that applications were “under review,” when they weren’t.

Gisele talks about how these events led her to protest Wall Street banks. Hopefully they lead more people like her to do the same. Otherwise these banks will continue to treat customers like cogs in a system and give preference to people like Tim Geithner.

Leave a Reply